PrivacyPortfolio's Vendor Risk Management Platform

This is my homemade Vendor Risk Management Platform.

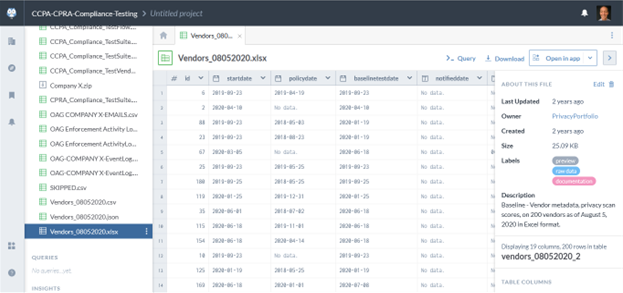

As you can see, I have an inventory of all my vendors, which I maintain as a dataset in my data catalog.

It’s open to the public, but each vendor is de-identified and other identifying details are redacted.

This platform offers the ability to share and correlate datasets with researchers, vendors, enforcement agencies dynamically in real-time or for static point-in-time. For each vendor, I have a folder for storing all my agreements, assessments, and evidence. Each folder is encrypted and stored inside a tagged container within a data pod store for all my vendors. On my laptop, these folders look like ‘regular folders’:

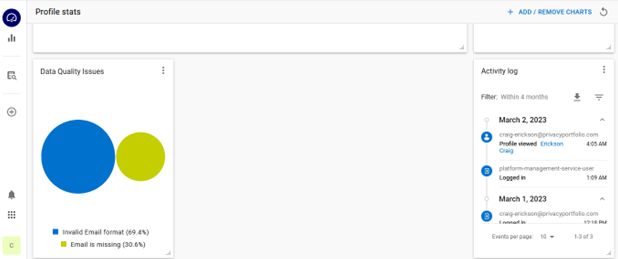

In addition to using data.world as my data catalog, and Inrupt SolidPods as my secure data store, I also use Reltio Identity 360, a master data management tool that calculates the quality of data I collect.

Any code or other tools I use for collecting, processing, protecting, accessing, or sharing any of this information are maintained in my public or private Github repositories.

Craig Erickson's Vendor Risk Management Program

My Vendor Risk Platform

has no utility or value without my Vendor Risk Management Program.

My Vendor Risk Program

defines and classifies who is a vendor, how the vendor and their

resources will be evaluated,

and guides which actions I

can take to reduce my risk exposure.

“Know Thy Vendor” is the first principle of my Vendor Risk Program.

If my vendor obfuscates who

owns the business or brand, where they are located, or how to contact

them,

I can't identify who I'm

sharing my personal information with, or how it's being used.

“Vendor Communications” is the second principle of my Vendor Risk Program.

A vendor who can’t or won’t

communicate is a very big risk.

Vendors often protect

themselves by restricting communications through third party service

desks,

unattended email aliases,

and third party email and messaging systems.

“Vendor Value” is the third principle of my Vendor Risk Program.

If what the vendor offers

doesn’t provide adequate value to me, I can't afford to manage that

relationship.

Value is a risk factor. Cost

is a risk factor.

It can take time to verify

that a product or service works as advertised,

and evaluate whether it's my

usage or the vendor's performance that needs improvement.

That’s why I onboard vendors

first and vet them later. I'll either terminate the relationship

or take other measures to

reduce any risks -- after I find out what those risks are.

Vendor Risk Management is NOT synonymous with Third Party Risk Management.

My relationship to my

vendors are first-party relationships and personal information I

voluntarily share with my vendor is first-party data.

My third-party relationships

are with my vendors’ vendors and personal information my vendors share

with their vendors is third-party data.

Organizations that sell personal information to my vendors are also third parties,

which includes data brokers and other sources of consumer profiling.

Vendor Risk Assessments

If there is a risk of

physical, emotional, social, or financial loss due to a vendor,

I need to assess that risk

and handle any issues.

Consumers and businesses

both have legal and financial mechanisms to reduce these risks and in

some cases,

compensate for losses, but

this too, takes effort on my part to maintain my own financial leverage

or legal standing.

For example, if a vendor

responds “Yes” they have both MFA and SSO available to protect access to

my account, but I decline to use it,

my risk is greater. I never

ask them, “What’s the risk of using your product or service if I ignore

all your recommended best practices?”

When I manage vendor risk on behalf of a business, I’m concerned about:

- How I’m going to provision the offering and delegate access to users

- How I’m going to patch the offering or report issues to receive support

- How I’m going to train users on best practices

- How I’m going to remove or replace the vendor’s offering if necessary

In essence, to reduce my risk exposure, I first make sure the offering suits my requirements, and then make sure I’m using the asset in accordance with the vendor’s recommendations.

Data Quality as a Risk Factor

Shipping my order by mistake

to someone else’s house, or erroneously sending my bank statement to

someone else’s inbox

is a risk of doing business

that I've come to accept.

It's just a flaw - an issue

like any other issue, which may or may not be resolved.

Issues may be caused by

logic or process flaws, which are difficult to determine from the

outside.

Issues could also occur as

the result of poor data quality. And poor data quality can be due to the

consumer voluntarily submitting data,

the business processing the

data, or the entity who sells, purchases, or steals data.

Collecting data from

multiple sources can improve data quality by correlating and verifying

the data.

"It depends" -- validating

residential addresses with the USPS, for example,

is considered by most

businesses to be more accurate than the address provided by the

consumer,

and typically overwrites the

consumer-provided address.

Digital identities are more

challenging,

and as the pool of data

sources increase, data quality can increase or decrease –

and this often depends on

accessibility of data sources. Searching someone on Google free of

charge

yields very different

information than paid subscribers to CLEAR, a service from Thomson

Reuters.

Availability is also an

issue:

Verifying a person’s

identity is unreliable when the consumer or the business relies on

technology

vulnerable to service

disruptions.

Reference data should be

durable or relatively stable, at the least.

If not owned or governed by a

generally-accepted standard like International Time Zones,

everyone is free to choose

their own source of reference data, or they can create their own

self-sourced reference data.

Classifying individuals and

organizations into groups is a generic activity for managing risk.

If I want to protect myself

from registered sex offenders, I’ll need a list. But whose list?

Anyone can post a list.

Whether the list is about Deadbeat Tenants who don't pay rent,

or Deadbeat Data Brokers who

didn't pay their registration fee,

the quality of data matters

because it impacts what decisions are made

or action taken by the

person relying on that data.

Using Master Data Management to score Data Quality of Personal Profiles

As you can see, I have a

tool called Reltio Identity 360,

which allows me to compose

and maintain consumer profiles shared with specific vendors

and third parties who sell

my personal information.

By measuring the cumulative

quality of data associated with each consumer profile collected by my

vendors,

I can tag and track specific

datasets because I also master and govern my own personal information.

“Know Thy Vendor”, or

“Know Thy Customer”, or “Know Thy Enemy” are all first principles of

Vendor Risk,

and all center on

identity – which has no one single authoritative source of truth.

Who decides what my name is, how it’s spelled, or even how it's pronounced?

If it's not me, then who or which authority establishes my legal identity?

How does a consumer prove who they are?

I chose my US passport and

my photo on LinkedIn to be my two authoritative sources of my digital

identity

for verification purposes,

which has been notarized at my financial institution and posted on a

website domain I control.

According to the California

Privacy Protection Agency, this form of identification is not necessary

for consumers who

submit verifiable requests

to exercise their privacy rights.

But none of my vendors,

including my bank where my identity proof was notarized, accept my

proof.

Without digital identity

standards for authoritative documents and reliable mechanisms to

transport them,

everyone has their own

process, perhaps consulting their own reference data.

Some businesses use credit

cardholder data to verify the age of minors, while others use public

information,

like the US Census; or

private information, such as Melissa Data.

On the other hand, identifying my vendor is much more challenging –

I have even fewer tools and resources as a consumer,

and this step competes and interferes with the desire for immediate fulfillment.

When I install a mobile app,

visit a website, click on an advertisement, agree to accept all

cookies,

or perform simple tasks like

scheduling a meeting, signing electronic documents, or verifying my

email address,

I can’t verify who I’m

interacting with.

Is it a legitimate corporate entity or just some guy who runs a website,

or a bot behind a proxy that exists only for the moment?

Should I accept a third-party privacy policy?

Is it safe to download resources from another domain during the install process?

Entity resolution and

identity-proofing are essential techniques in managing vendor risk.

Phishing and malware attacks

cannot be mitigated by telling people to avoid clicking on a link from

an untrusted sender --

because that's the normal

business practice today.

How does your organization

provision its users to a new application?

Chances are, they are

invited through a vendor's third-party-hosted email system

via a donotreply email alias

that identifies neither the vendor, the resource, or the authorized

purchaser.

The California Consumer

Privacy Act (CCPA) is an essential tool for consumers managing Vendor

Risk

As a California Consumer,

exercising my privacy rights under the CCPA is like having an insurance

policy

against the unauthorized use

of my personal information.

I can seek redress from a

problematic vendor, after I “sign up”.

But I can’t return a

purchased item without a receipt,

or report that my product or

service wasn't delivered if there’s no return address or agent to

assist me.

I could turn to an agency

that enforces laws and governs business practices, as a form of

insurance.

But to file a claim, I needs

a legally enforceable policy,

proof in order to collect on

the claim,

and often I'll need an agent

to represent me who can assist me and possibly exert more influence

over the vendor than I could.

To make sure my claim is processed, I need to know:

- The corporate name as registered with the Secretary of the State the entity was formed;

- Nonbusiness entity

- Annual revenue;

- How many consumers’ personal information is sold or shared;

- Which “Categories of third parties” are with whom the business shares personal information.

- How the business verifies my personal identity.

My Vendor Risk Platform

is an essential tool for managing and testing my privacy rights

under the California

Consumer Privacy Act (CCPA)

I might have a legal right,

doesn't that guarantee I have 'legal standing' to pursue redress for

violations of my right,

nor the capability to do so.

My Vendor Risk Platform

provides the tools, the processes, the evidence, and the guidance

to ensure that I comply with my obligations as a consumer under the CCPA.

There are many exemptions,

exceptions, and other legal 'loopholes' which can be used to deny me

a fair opportunity to

present the evidence I have collected in support of my claim.

Only by testing the CCPA can

my Vendor Risk Platform identify vendors I consider risky because they

are 'uninsured';

i.e. businesses that are

either not covered by the CCPA,

or illegal business

activities which are not enforced by the appropriate agency.

My Vendor Risk Management

Program and Platform are real tools I use to manage my vendors.

How effective these tools are in protecting my personal data is for now, experimental.

I can only hope that this experiment will be educational for all participants and observers.

As a followup to this article, I will be offering a hands-on lab that uses my Vendor Risk Platform to process personal information under the CCPA. This learning lab is designed to help people reach specific objectives within a specific role-context. For example:

- "I am a Developer, and I want to protect sensitive personal information from being improperly shared"

- "I am a Product and Marketing Director who wants to avoid unnecessary requirements that could cause additional expense and delays in our product launch"

- "I am a Consumer who wants to know if my vendor is a high-risk CCPA-covered entity."

- "I am a third-party privacy consultant providing privacy-preserving products, services, and advice to businesses, and my clients need to know if our firm's solutions comply with the CCPA."

- "I am an enforcement agency investigating a complaint regarding a business' privacy and security practices, and I want to discover similar violations with other relevant laws"

- "I am a data broker registered with the State of California who wants to assess if my security and privacy risk controls support CCPA-compliant business practices"

- "I am a vendor risk manager, and I want to know if my suppliers are violating the contract terms required by the CCPA."

- "I am a third-party auditor who wants to know how many CCPA requirements are met using existing NIST controls."

- "I am an authorized agent for consumers who want to report CCPA violations in complaints or incident reports to appropriate enforcement agencies."

Please send me an email

if you'd like to participate in these learning labs when they are available.

Sincerely,

Craig Erickson, a California Consumer

Published 04/04/2023